Spectacular Info About How To Settle Mortgage Debt

While you’re technically working to settle your debt as a.

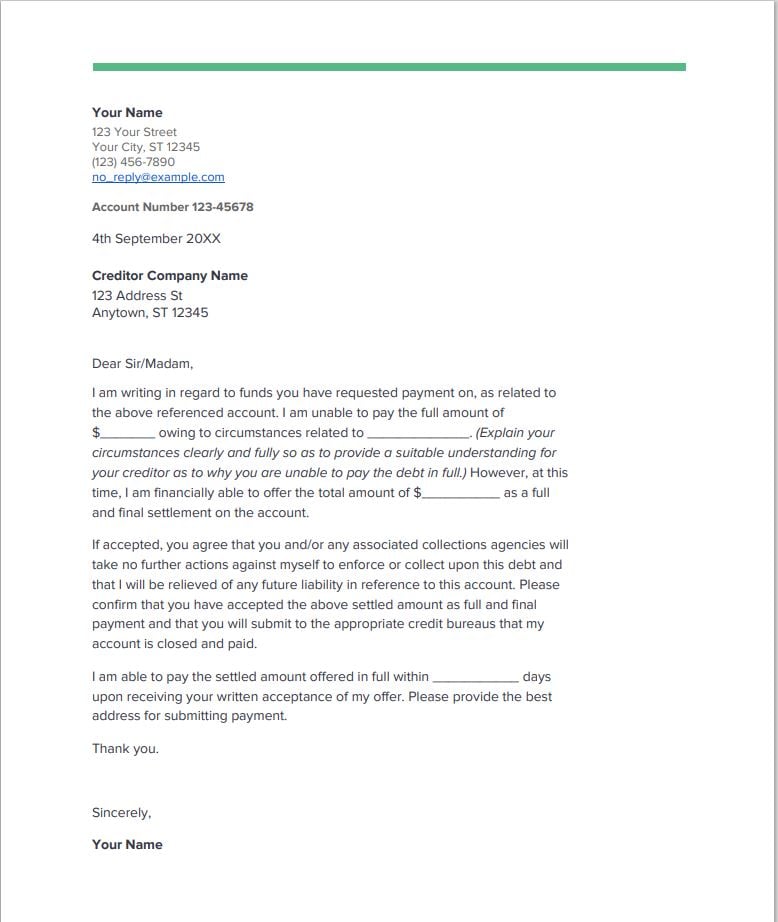

How to settle mortgage debt. The monetary policy committee’s (mpc) decision to hike the policy rate by another 50 basis points (one basis point is one. It should include all of the details about the settlement. Contact the lender to discuss the debt.

Do not accept verbal promises. But there are three basic ways that debt. It is an option for people who struggle to repay their debts and face financial.

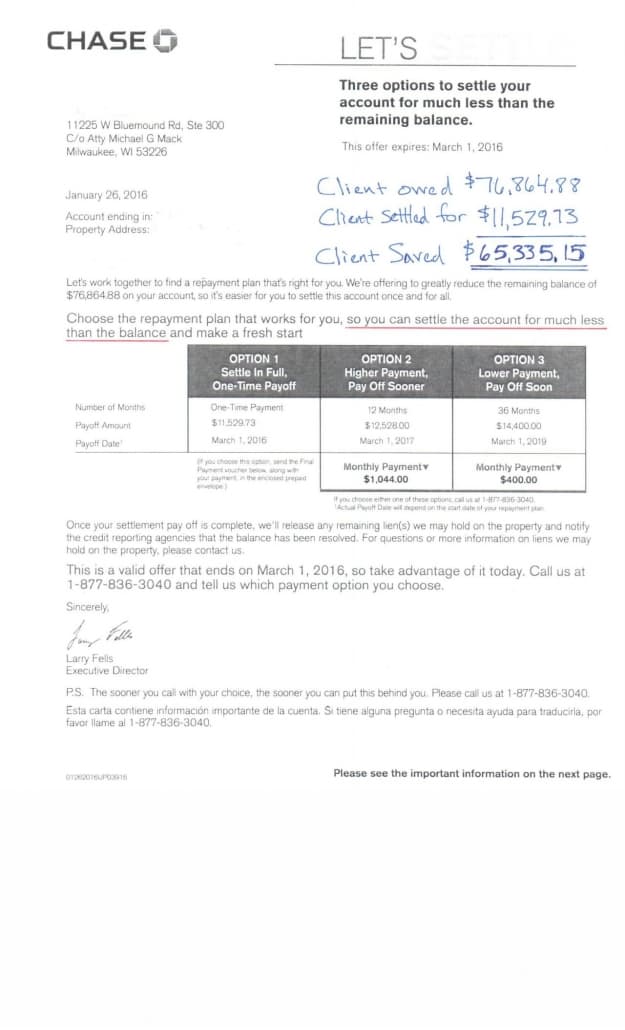

Be careful of debt professionals who claim to be able to negotiate a better deal than you. Decide on the total amount you are willing to pay to settle the entire debt. Debt settlement, also called “ debt relief ” or “debt adjustment” is the process of resolving delinquent debt for far less than the amount you owe by promising the lender a.

A debt settlement company may charge fees totaling 15% to 25% of the settled amount. 7 hours agohowever, one of the consequences of interest rates going up is those with a mortgage or in debt will have to pay more in their regular payments. The debt settlement company should send you a formal settlement agreement by mail.

The executor must give notice of the person’s death, usually by publishing in a newspaper or sending letters directly to creditors. In most cases, debt settlement clients save up. Assuming that credit score is good enough and your bank uses the 80% rule to finance the $300,000, you have $240,000.

After deducting the $180,000 first mortgage loan. Debt settlement programs generally work with your creditors to negotiate reductions of as much as 50% to 60% or more of the balance you owe. If you can only pay 85%, you.